How to tweak the currency meter for your trading strategy?

You’ll be able to look across the row and see one currency’s correlation with other major currencies.

You’ll be able to look across the row and see one currency’s correlation with other major currencies.

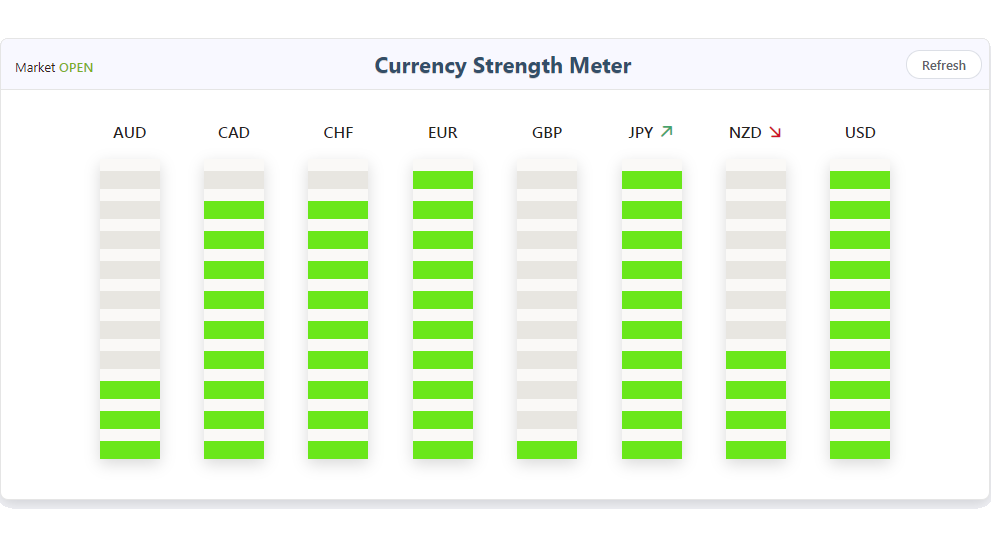

A currency strength meter is a technical indicator used by traders to obtain information about the strength of an individual currency relative to its peers. More generally, a currency strength meter is a trading tool that measures a currency’s performance against a basket of other foreign currencies. Currency strength meter is a measure of a currency's strength against its peers.

Although strength meters have gained popularity over the years, they have been available since the early days of foreign exchange trading. Nowadays, they are used to help investors make decisions as to which currencies to buy or sell. In essence, currency strength meters measure the strength of a country's currencies against its peers. This may seem obvious, but it’s worth explaining why it’s important to know that a currency is strengthened or weakened against its peers. The reason is simple: as you know, all currencies are traded in pairs, not in isolation. That is, you must know how two different currencies are traded against each other.

Every currency has a different degree of strength against its peers, so it’s important to know when the time is right to buy one currency and sell another. The currency strength meters are based on an algorithm, which helps traders determine the strength of a single currency. This algorithm is based on the price and volume. In essence, it determines the value of a currency relative to its peers. That’s why traders lose money even with a “GPS’ in their hands. It depends on the timeframe you choose, which is why the longer the timeframe the higher the accuracy. In 2021, the weakest world currencies are the Venezuelan Sovereign Bolivar, the Iranian Rial, the Vietnamese Dong, the Indonesian Rupiah, and the Uzbek Sum. The indicator is widely used on MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

See these two indicators (click on the image to open)

In the first case we have absolute strength of currencies

In the second we have relative strength

For intraday trading, it is typically recommended to use up to 200 bars for intraday trading, while for scalping, up to 50 bars should be enough. Strongest currencies that perform against other currencies are marked green, while the weakest are marked red. The biggest potential deal is to sell EUR/JPY.

The currency strength indicator is the secret weapon of successful trading. If you want to learn more about our proprietary currency strength indicator, here is a quick overview of its 3 main features. The U.S. Dollar is currently considered as the strongest currency in the world.

For example this currency strength meter calculates the % change in price to rank currency pairs from strong to weak. What might also happen is that one of the pairs indicates a strong movement, while the other is just ranging, which signals traders to avoid entering trades. Around 60% of the world’s central bank reserves, 40% of debt, 90% of forex trades, and 80% of global trade is denominated in dollars. They provide a snapshot of the forex market, so always check the most up-to-date version. Forex strength meter guide doesn't help traders navigate through the volatility. You need to place the pair that has reached the highest price right at the top.

Forex strength meter is a beginner-friendly indicator that helps you find the strength of a currency. The indicator combines multiple forex tools for finding low-risk entry points for trades. In other words, you will not have to spend countless hours looking for the right time to enter a trade. Forex strength is not a typical buy or sell indicator.

This combination is unique to the forex market and it allows you to get highly accurate trade entries. On the other hand, a weak currency is one which loses value in relation to other currencies, which means that its growth rate is low compared to other currencies.

It's important to note that there is no perfect indicator for forex trading. A currency strength meter doesn’t tell you when to enter a trade, it only helps you to filter for potential currency pairs to trade. Because the currency strength meter is using multiple time frames, it is not suited for scalping.

The algo is a mechanical mean reversion strategy that trades price patterns in the EURUSD. It even allows you to choose a strength for a certain period. Free currency strength meter downloads are always risky, and you should be careful with them.

Although the indicator doesn't provide 100% accurate signals, it's useful when identifying a trade's direction. The best way to measure currency strength is with currency correlation. The CSM is not 100% accurate.

Some products might even produce data that's moved away from the original concept of what currency strength actually is. For intraday trading, it is typically recommended to use.

The best way to trade with the indicator is to find the strongest and the weakest currency. As a result, we pair the two currencies and end up with NZD/CHF, which has a potential buying opportunity. By comparing this information to the information shared in a currency strength meter, you will get a deeper sense of a currency's strength, and it's potential to strengthen or weaken.

To use the currency strength meter effectively, you need to avoid going long on two pairs of currency moving in opposite directions. A -1 correlation means the two pairs will move in the opposite direction 100% of the time. In addition, you can decrease your losses while hedging two pairs of currencies with a negative correlation that is close to perfect.

Indicator is built on the mathematical correlation of 28 currency pairs. The US dollar, the Canadian dollar, the Swiss franc, the euro, The British pound sterling, the Australian dollar, the New Zealand dollar, and the Singapore dollar are the strongest currencies in the world for now. If the pair is red, this indicates that the bears are winning the war. PPP is a theory that compares the cost of a ‘basket of goods’ in different countries using their respective local currencies.

The Currency strength meter is a general term for an indicator that shows whether you are dealing with a strong or weak currency. The device can provide a concise overview of several kinds of currencies.When the Currency strength meter calculates the fluctuations in other corresponding currencies within a timeframe, it gives you a clear picture of the performance of your currency.

By using this service, you have accepted Cookies based on our

Privacy Policy,

and Terms of Service.

Manage your permissions here.

I agree to the I have been informed and read the Privacy Policy. I understand that Found.ee, LLC. Will process my data as data controller to manage my registration with found.ee, which is necessary for the performance of the contract, and that my data will not be shared with third parties unless legally required. I am aware I have the right to access, rectify and erase my data, among others.

You may select your cookie preferences below

Under the California Consumer Privacy Act, the definition of 'sale' is very broad. It includes the transfer or sharing of personal information with a third party for any value, even if the information is not sold for monetary value. We do not sell actual personal information for monetary value, but we do allow users to run advertising against it and share it with third parties as part of a mutually beneficial business relationship. Because of this, we refer to the sale of personal information as 'data sharing.' If you are a California resident, you have the right to opt-out of the sharing of your personal information with third parties (subject to certain exceptions).

Do not sell my personal information